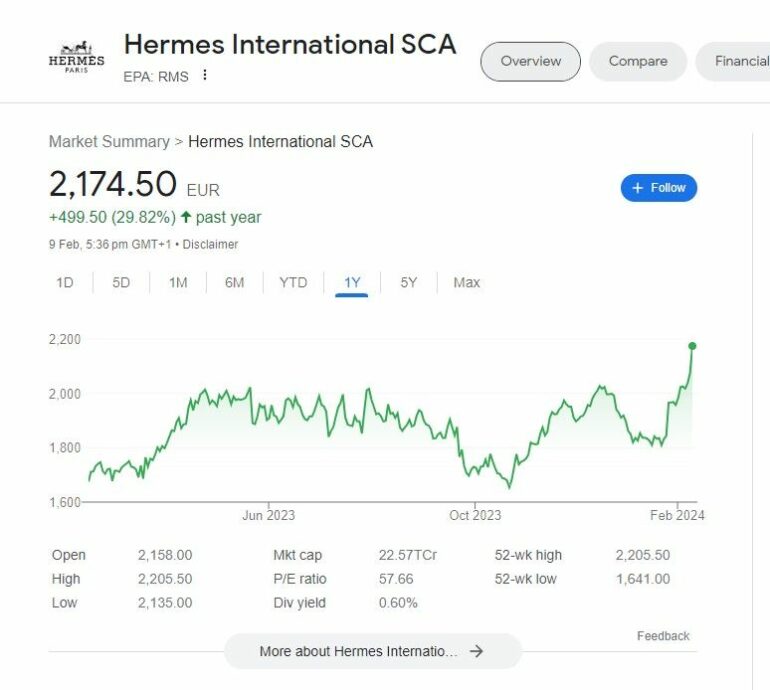

Reputation supports remuneration, and luxury label Hermès is a shining example of this. The French luxury design house’s shares rose to a record high on 9th February 2024 after the brand, founded in 1837, outpaced its rivals at the end of 2023. 2024 began on a good note for the luxury label, which stated it will further raise its prices globally by between 8% and 9% this year. That will not deter Hermès loyalists and admirers from bagging their next desirable Birkin bag.

A pioneer and one of the most consistent performers in the luxury goods industry, the shares in the company opened 4.2% higher after sales for the three months to the end of December totaled $3.62 billion, per Zawya. The brand exceeded all estimates, including the 14% growth expectation, reporting a 17.5% increase in sales in the last quarter of 2023. “Hermès is playing in a different league,” JPM analysts said in a note. “Hermès comes in today showing, in our view, what a real over delivery is about,” they said, pointing to strong brand momentum and strong cash returns to shareholders. Citi analysts said, “Hermès is well-positioned in 2024.”

This steadfast growth, nearly guaranteed success, and an unfaltering fan base have catapulted Hermès to a higher valuation than rival luxury groups. According to LSEG data, Hermès’s 12-month forward price-to-earnings ratio, based on projected earnings, is 47.7, while staunch rival LVMH is at 24.2 and Kering at 15.6. To celebrate their successes as usual, Hermès stated the luxury house will pay a 4,000 euro bonus to each of its over 22,000 employees worldwide. This time last year, the Maison did the same, granting each of its 19,700 employees an exceptional bonus of €4,000. In 2023, Hermès had no fewer than 22,000 employees, which means the brand created 2,100 jobs in one year.