Like all other investment banks, Goldman Sachs was the poster boy of American capitalism till the market crash of 2008. Post the market meltdown, the investment bank received many flaks for reckless trading, multimillion-dollar bonuses, golden parachutes for executives, etc. The bank was pulled out from certain bankruptcy by an investment by Warren Buffet and a $10 billion TARP bailout which the company paid back in less than a year, and in the end, the taxpayers made a $1.4 billion profit. The investment bank is now stronger than ever and is delivering stellar profits. Did you know that the company hired a summer intern into its Investment Management unit who thought Portugal is next to Mexico City. Needless to say, she did not get a return offer. We have compiled a list of 10 less-known but very interesting facts on Goldman Sachs after the jump.

No 10 – Unlike their rivals, Goldman’s equity research analysts never, ever go on TV to discuss their opinions.

No 9 – 60% of their top executives are Jews, who only account for 2% of the US population. This is reportedly the highest ratio among peers. (Pictured above Chairman and CEO – Lloyd C. Blankfein)

No 8 – It uses 1 million computing hours per day for risk management calculations.

No 7 – The average employee tenure in 2011 was 5.5 years, up from 5.0 years in 2008 and 4.5 years in 2001. The average tenure for executive officers is 22 years. Each employee receives on average 25 hours of training per year.

No 6 – Known widely as an investment bank it only generates 14.4% of its revenue from investment banking. The bulk, 53%, is from sales and trading.

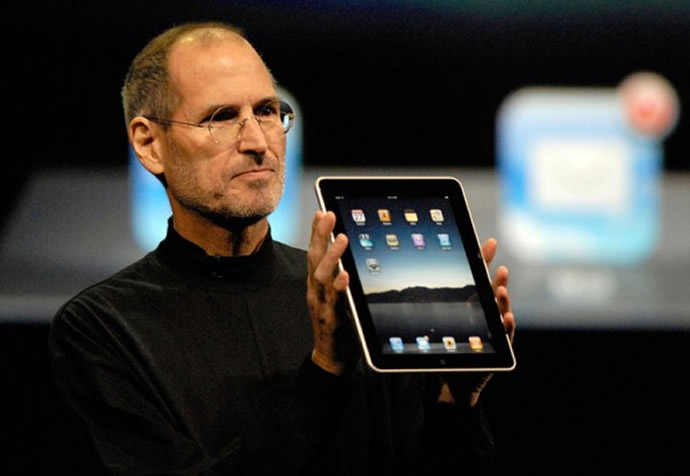

No 5 – By market value, Goldman Sachs is 35% the size of JP Morgan and just 19% the size of Apple.

No 4 – In 2010 and 2011, Goldman received 300,000 applications for full-time positions. 4% were given offers. Of the applicants who receive offers, 9/10 accept.

No 3 – Sidney Weinberg, who started off as a janitor’s assistant, went on to become the CEO and led the firm for 39 years.

No 2 – Red flags raised by two young analysts prior to the ’08 crash arguably saved the entire firm. While their top energy analyst predicted that oil would surge to $200 a barrel in 2008 (chart above). He made the call in May when oil was trading at $105. It crashed to $30 a barrel four months later.

No 1 – The average employee compensation (salary + bonus) was $399,506 in 2012. Revenue per employee was $1.29 million in 2012.

[Some images are used for representation purposes only. Sources include – Wikipedia, Goldman Sachs, and other inputs]