Amazon’s founder, Jeff Bezos, is more strategic than sentimental, a trait that has solidified his position as the world’s second-richest man, with a net worth of $234 billion, according to Forbes. Earlier this year, in February, Luxurylaunches reported that the centibillionaire had relocated to Miami after spending years in Seattle, a move partly driven by a desire to be closer to his parents. However, this decision had another significant upside, saving over $600 million in taxes over the next year.

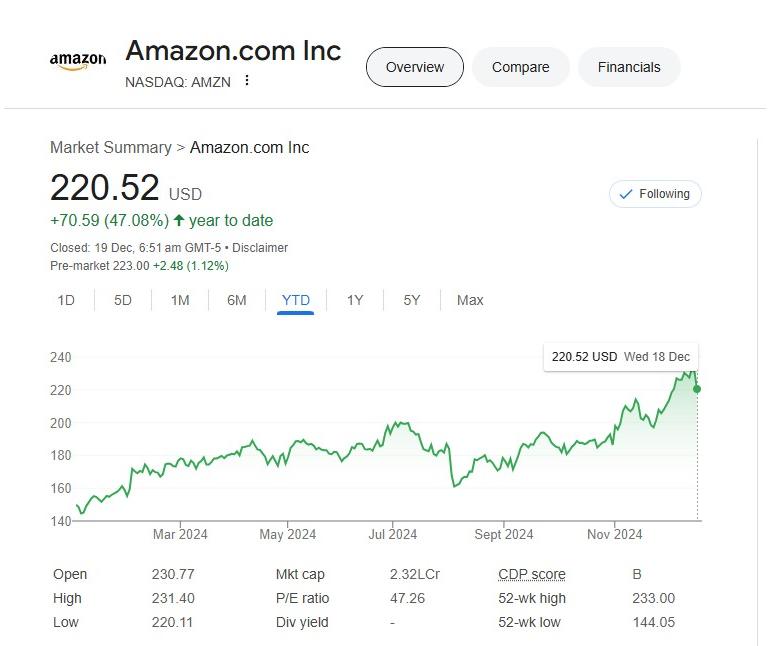

As the year draws to a close, Forbes reports that Bezos likely saved an estimated $1 billion. The financial advantage comes largely from Florida’s tax policies, which include no state income tax or capital gains tax. This contrasts sharply with Washington state, which introduced a 7% capital gains tax in 2022 on sales exceeding $250,000. This year, Bezos sold $13.6 billion worth of Amazon stock, the highest amount sold by any U.S. billionaire in 2024 and his largest sale in two years. The 60-year-old entrepreneur also invested in his Miami lifestyle, purchasing three mansions on Indian Creek, Florida’s so-called “billionaire bunker,” for a staggering $234 million. Establishing legal residency in Florida has enabled Bezos to further minimize tax liabilities, including income, capital gains, and estate taxes.

Forbes highlighted the financial impact if Bezos had remained in Washington. His 2024 stock sales would have incurred a $954 million state capital gains tax bill, an amount exceeding Washington state’s total tax collections of $848 million for the fiscal year ending in June. While Bezos owes $3.2 billion in federal taxes from share sales, his strategic relocation has undeniably paid off.

Bezos retains a 9% stake in Amazon despite selling a significant portion of his shares, likely to diversify his holdings, fund investments, or finance other acquisitions. Over the years, he has invested in over 125 startups, purchased eight homes for $500 million, and spent another $500 million on his mega yacht, Koru, the world’s largest sailing yacht. Following closely is his $75 million yacht, Abeona.

“For someone with that much wealth, just the estate tax savings alone can amount to $10 billion, not to mention the ongoing income tax savings,” said John Pantekidis, managing partner and general counsel at TwinFocus, a firm managing over $7 billion for ultra-high-net-worth families, in an interview with Fortune. “Florida is very, very favorable for someone like Jeff Bezos. They make it very cost-effective for folks like Jeff to live down there. It’s ideal, it’s nirvana.”

Bezos’ calculated moves underscore his knack for wealth preservation and strategic foresight, proving once again why he remains a dominant force in the billionaire world. Florida, it seems, is not just his new home, it’s his financial sanctuary.