Can an investment of only $10,000 make you a billionaire in less than three decades? Don’t be too quick to laugh it off thinking that it’s impossible, because that’s exactly what happened with Amazon founder Jeff Bezos’ siblings. It is believed that Jeff held 60 meetings with family members, friends, and prospective investors back in 1994 in hopes of getting an investment of around $50,000 apiece in Amazon to help him raise $1 million. Out of all the people he met, only 20 of them agreed to put their money into Jeff’s wild idea. The group of early investors included his parents, his younger brother Mark, and his sister Christina.

According to a 1997 SEC filing unearthed by Bloomberg, Bezos’ siblings Mark and Christina each bought 30,000 Amazon shares for $10,000 in 1996. Just to put that into context, a Honda Accord had a sticker price of more than $14,000 in those days. But, you’ll be astonished to know the current value of the stocks held by them. If Bezos’ siblings haven’t sold any of their stocks yet, their individual stakes would be worth $1.025 billion. That’s a mind-blowing return of more than 10 million percent (10,249,900% to be precise) in just 28 years. It might be one of the most successful venture investments of all time. However, investing in Amazon in its fledging days was fraught with high risks.

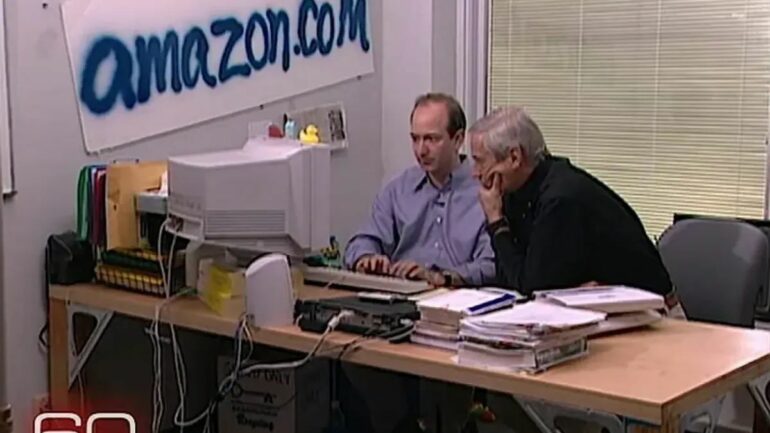

Bezos noticed the potential of e-commerce early in the 1990s and wanted to create an online bookstore to cater to the masses. He was impressed by how quickly web usage was growing (at 2,300 percent a year in the mid-1990s) and founded Amazon in July 1994. However, the internet was still majorly used by government agencies and universities in those days, which was a big risk for the former Wall Street executive’s entrepreneurial dreams. “I want you to know how risky this is,” Bezos even told his parents before they invested, “because I want to come home at dinner for Thanksgiving and I don’t want you to be mad at me.” He even made it clear to his family that there was a 70 percent chance they wouldn’t be seeing that money ever again. But it turned out to be their best decision ever!

Amazon went public on May 15, 1997, with an IPO price of $18 per share. Faced with many challenges in its early years, Amazon’s stock experienced both ups and downs. However, it slowly gained traction as the company expanded its business beyond online retail. While many internet companies collapsed during the dot-com bubble in the late 1990s, Amazon survived and continued to grow. Thanks to Bezos’ entrepreneurial spirit and innovative approach, Amazon went on to become one of the most successful companies in the world with a current market cap of $1.5 trillion. This helped its early investors become some of the wealthiest people on this planet.

The exact number of Amazon stocks Mark and Christina currently holds is unknown; however, both of Jeff Bezos’ siblings are still closely linked to Amazon. Jeff’s younger brother is a director of the Bezos Family Foundation, a philanthropic organization started by Jeff’s parents in 2000. The 55-year-old himself has had a successful career. Rather than working with his elder brother, he started in advertising, working with several leading ad agencies.

He later went on to start own firm, Bezos-Nathanson, which to EastWest Creative in 2005. After taking an exit, became Head of Communications at the Robin Hood Foundation and stayed there till 2006. Currently, Mark runs his own investment firm along with successful professional investor David Moross. The Bezos brothers also share a close bond and flew to the edge of space together back in 2021 on Blue Origin’s first tourist trip to space.

Unlike Jeff and Mark Bezos, Christina prefers to stay away from public attention. Very little is known about her despite being the younger sister of the world’s third richest man. Serving as a governor at the Bezos Family Foundation, she also shares a close bond with her brothers and has always supported their dreams. Christina was there to motivate her siblings when they went on their trip to the edge of the space. Before the flight, she wrote a message for her brothers that read: “As you buckle in, I’m reminded of when Jeff was Captain Kirk, Mark you were Zulu, and I took the role of Lieutenant Uhura, “We would battle Klingons while firing torpedoes, all the while dodging in and out of traffic and praying that we may get to our destination safely.”

Note – As reported in the Bloomberg story published on July 31, 2018, the stakes of each of Jeff Bezos’ siblings were valued at $640 million. This valuation was based on Amazon’s stock closing price of $91 on that day. As of the writing of this article, Amazon’s closing stock price is $146.32, which values the stakes of Mark and Christina Bezos at $1.025 billion each.”