Japanese women prefer Cartier watches, domestic travel and read news on social media, while their Korean counterparts favour Tiffany & Co, foreign trips and follow KOLs, research shows

Women have always been a priority segment for luxury brands, and as female spending power has increased, the luxury sector has been struggling to catch up.

Although on aggregate the spending power of affluent Korean and Japanese women is not as large as that of Chinese women, they still represent an important consumer group to which many luxury brands need to cater and better understand, according to a survey carried out by Agility Research.

“Japanese women are more spontaneous in their expensive purchases compared with Korean women, who like to plan their luxury purchases” – Agility Research

High-net-worth (HNW) women from both countries were questioned about what they thought of themselves in terms of their personalities, use of social media, brand preferences, travel destinations, finances and property investments.

Here’s how they compare.

Luxury shopper personalities

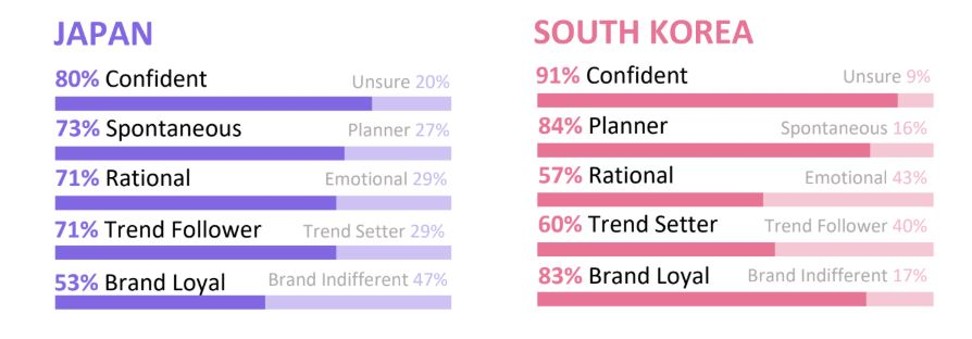

Both Korean and Japanese women are confident when making their luxury purchases.

However, their shopping personalities differ in many other aspects. Most importantly, Japanese women are more spontaneous in their purchases compared with Korean women, who like to plan their luxury purchases, the research shows.

“Rich Korean women are more likely to use social media for luxury related purposes, with 50 per cent looking at what brands and products celebrities are wearing or using” – Agility Research

Although they are spontaneous, Japanese women consider themselves to be more rational than emotional consumers.

They buy for a valid reason and recognise themselves as trend followers – neither brand loyal nor indifferent. This suggests that they do not have particularly favoured brands and are more likely to try new brands or products that are considered in vogue.

On the other hand, Korean women are only slightly more rational than emotional when purchasing luxury.

Yet they consider themselves significantly more brand loyal than Japanese women do. Furthermore, they also describe themselves as “trendsetters”.

Use of social media and key opinion leaders

The use of social media has increased over the past decade and become an integral part of many women’s lives.

With different usage habits, it is clear that Korean women are more likely to use social media for luxury related purposes, with around 50 per cent looking at “posts from luxury brands” and “what brands and products celebrities are wearing or using”, the survey found.

“About 26 per cent of rich South Korean women buy a luxury item because it was recommended by a social media influencer compared with 14 per cent of wealthy Japanese women” – Agility Research

This differs considerably with Japanese women who mostly use social media to keep themselves up to date, with 80 per using it mostly for reading news.

Korean women are additionally more influenced by social media, with 26 per cent buying a luxury item because it was recommended by a social media influencer compared with 14 per cent of Japanese women, the research shows.

Moreover, Korean women are more likely to use social media to display their luxury purchases, with 29 per cent posting pictures of luxury goods they own on their social media platforms, compared with only 13 per cent of Japanese women.

Brand preferences

A survey of affluent Korean and Japanese women’s spending outlook over the next 12 months revealed stark differences in their interests.

While Japanese women plan to spend more on premium or luxury watches, Korean women plan to buy more fashionable clothing. Within these categories, women from both countries have different brand preferences.

For premium or luxury watch brands, both Korean and Japanese women are interested in buying Chanel products, the research shows.

However, their first choices differ: Japanese women are most interested in Cartier, while Tiffany & Co is the Korean women’s preferred brand.

Love of travel

Affluent women from Japan and Korea are both interested in travel, the research shows.

However, when looking at number of trips they have made over the past 12 months, Korean women have made more international trips – both for business and leisure purposes – than Japanese women.

This could be attributed to Japanese women’s preference for domestic travel, as they are more inclined to have staycations and enjoy exploring their own country.

Conversely, affluent Korean women are more likely to make international trips, with Japan, the United States and Europe their top choices for future travel.

In terms of travel activities, affluent Korean and Japanese women have varied interests. For Korean women, shopping is the top choice, whereas Japanese women prefer to take part in city tours or more adventurous activities, such as diving or swimming at the beach.

“Korean women are more likely to make international trips, with Japan, the United States and Europe their top choices for future travel; Japanese women are likely to choose domestic travel, perhaps because they are more inclined to have staycations and enjoy exploring their own country” – Agility Research

When it comes to shopping preferences while travelling, 50 per cent of affluent Korean women say they mainly buy luxury brands when they are able to purchase them tax free or during trips, compared with only 20 per cent to 30 per cent of Japanese women.

Finances

The research shows that the financial priorities of affluent women in Korea and Japan are quite similar, with both of them concerned about long-term financial stability.

Japanese women are most concerned about “maintaining their lifestyle in retirement” but for Korean women it is about “saving a notable portion of their income”

Women from both countries are interest in investing in their futures, but Japanese women are more likely to rely on the help of financial advisers – with 75 per cent of them asking for advice from advisers compared with only half of Korean women.

Property ownership

Among the HNW women in both countries, Korean women are more likely to use private banks for managing their finances, with 57 per cent saying they have private banking compared with only 28 per cent of HNW Japanese women.

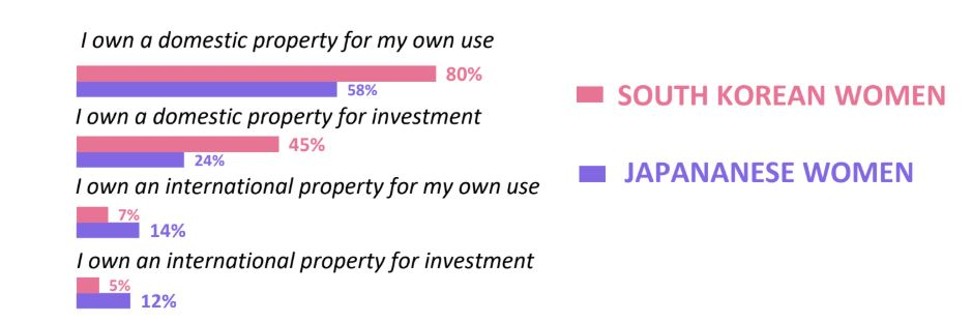

In terms of property ownership, Korean women are more likely to own a home of their own or a property as an investment, while Japanese women are more likely to own or invest in real estate abroad.

However, the research shows that Korean women are looking to expand their property portfolios, with 26 per cent “actively looking to invest in an overseas property”.

Note – This story was originally published on SCMP and has been republished on this website.