According to statistics, almost 90% of startups end up as failures. Only the most successful investors have the knack of recognizing value very early, earning them truckloads of money. However, even the most seasoned venture capitalists sometimes make poor decisions they remember for the rest of their lives. In a recent Instagram video for Bloomberg Business, private equity heavyweight David Rubenstein shared how he blew the golden opportunity to be one of the investors in Facebook. The 74-year-old regrets not putting in a paltry sum of $30,000 in Facebook during its early days, which today would have been worth $20 billion. It’s simply mindboggling that the investment would have earned Rubenstein a return of 66,666,566,667% in less than 20 years.

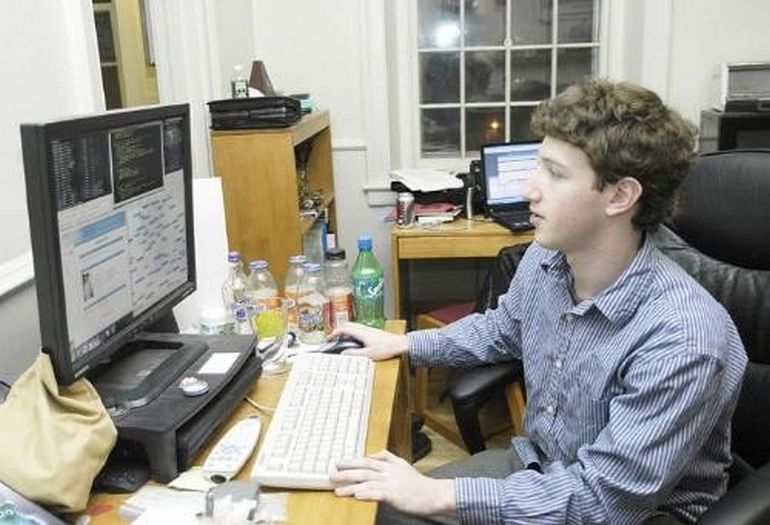

Rubenstein, a former American lawyer and the co-founder and co-chairman of the private equity firm The Carlyle Group, has talked about this missed opportunity several times in the past. Apparently, Rubenstein’s son-in-law went to Harvard with Zuckerberg and wanted to arrange a meeting between the two.

Back then, Zuckerberg was looking to drop out of Harvard to launch Facebook and was searching for investors to fund his social media platform. “I said to myself, what are the chances of this guy becoming the next Bill Gates? So I didn’t meet with him,” Rubenstein said while narrating the story back in 2011. “So now I have to work for a living.”

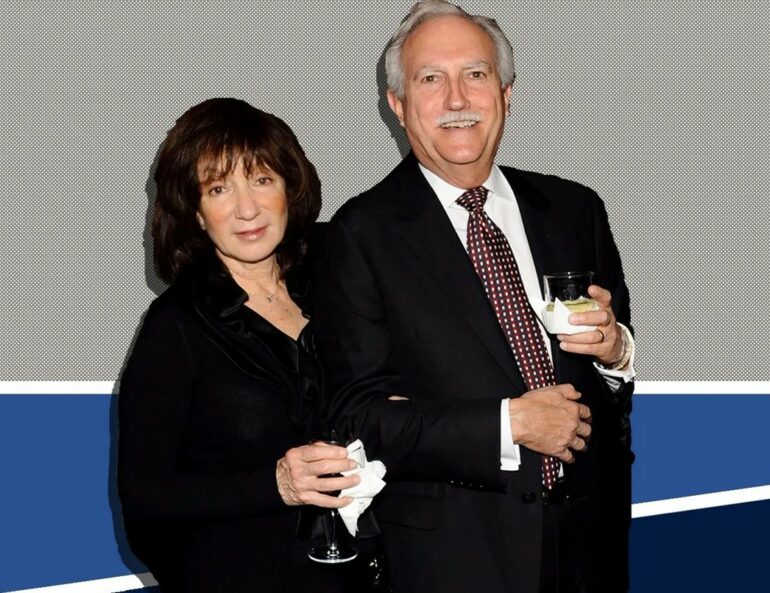

Early investors take the maximum monetary risk but get the maximum return if the startup becomes big. Case in point, Jeff Bezos’ family members turned into billionaires by investing in Amazon in the 1990s. While Rubenstein missed the boat on making $20 billion from an investment that could only buy him a top-of-the-line Honda Accord back in those days, Bezos’ family made a killing. The Amazon founder’s parents, Jackie and Mike Bezos, put $245,573 into their son’s business idea in 1995, which would be worth $48.4 billion today. On the other hand, Bezos persuaded his siblings to invest $10,000 in the company individually a year later, which is presently worth $1 billion each.

Rubenstein might have been richer by $20 billion had he met with Zuckerberg and agreed to invest, but he still has done exceptionally well for himself. After practicing law in New York for a few years in the early 1970s, he served as chief counsel to the US Senate Judiciary Committee’s Subcommittee on Constitutional Amendments from ’75 to ‘76. He also served as a deputy domestic policy advisor to President Jimmy Carter. Rubenstein co-founded The Carlyle Group in 1987 and built it into one of the world’s largest managers of alternative assets. According to the Bloomberg Billionaires Index, his personal net worth is close to $5 billion.