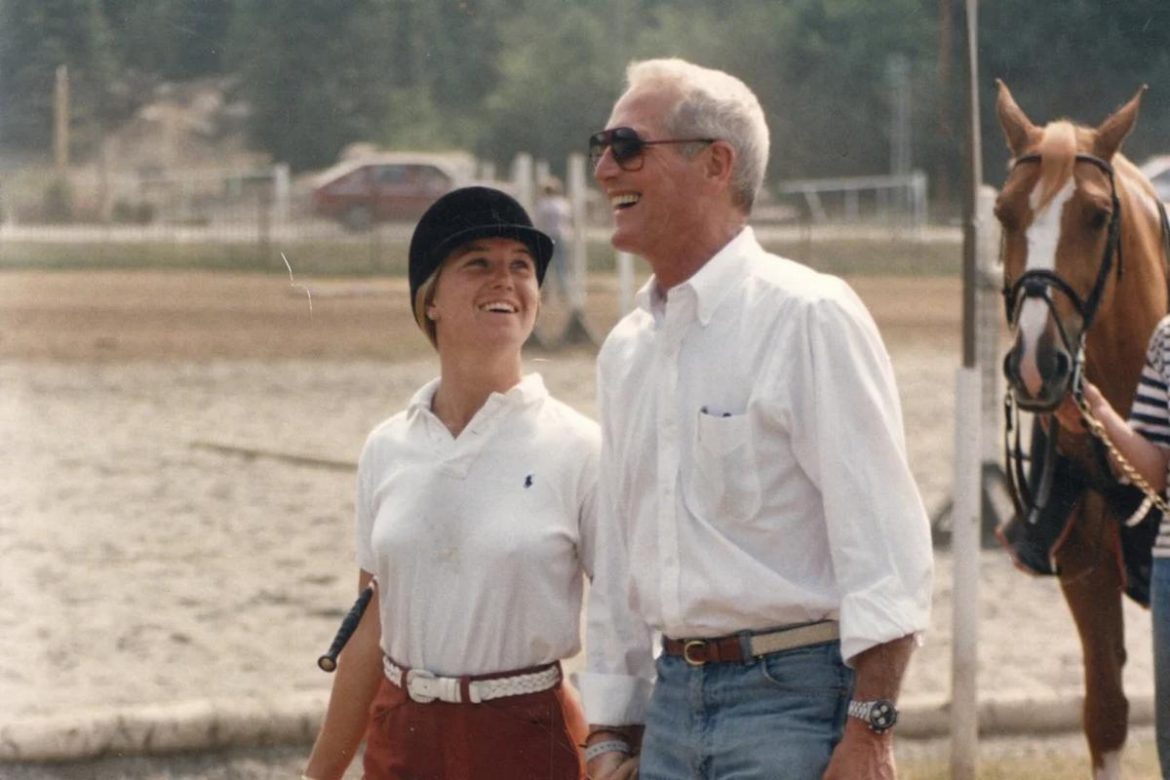

A United States Air Force veteran made international headlines earlier this year after learning that the watch he originally bought for scuba diving nearly 50 years ago for less than a month’s wages (around US$350) is now worth over US$700,000 in today’s market.

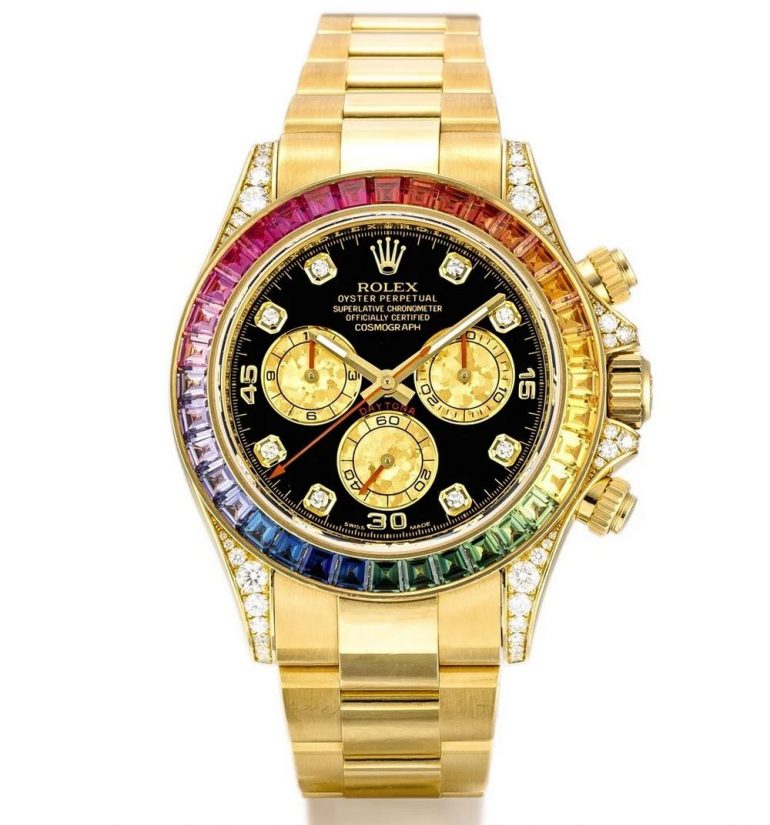

Half a century later, that 1971 Rolex Cosmograph Daytona Oyster – along with its original case, packaging, warranty papers and receipts – has been appraised at 2,000 times its original sticker price, easily beating any equivalent stock market investment, thanks in part to its pristine condition and to the Daytona’s notorious association with the late actor Paul Newman.

While replicating such results today is not nearly as widely accessible as it was 50 years ago – a new Rolex Daytona runs to around US$17,000 – luxury watch investments have seen an undeniable peak in popularity, something that is both intriguing for timepiece hobbyists and profitable for the right investors … but only if you’re willing to accept that your base-level knowledge will need to be built upon and finessed before making that first investment.

“Based on what I have observed with some of the top collectors/scholars, the pursuit of knowledge and the desire to know more helped them to build their dream collection,” explains Ho Zi-yong, head of sales, watches, at Phillips Asia. “They learn and refine their knowledge as they progress, allowing them to articulate [build foresight] and hopefully accurately acquire important timepieces.”

The high-end watch industry is subject to changing market sentiments and the rules of the economy, but unlike the stock market, when it comes to luxury watch investments, as supply falls, demand increases – and that is only amplified over the years if you have the patience to play the long game and don’t get partial to your collection.

“We make a big distinction between investors and collectors,” explains professional watch expert and founder of The Watch Fund, Dominic Khoo. “Investors in a commodities fund don’t really care for barrels of oil or coffee beans – and hardcore watch lovers don’t really care for 20 per cent returns.”

According to Khoo, the most important thing to take into account when dipping your toes into investing in the high-end watch market is to know who you are and be truthful with your intentions. The key is having an honest conversation with yourself: do you really want to build your timepiece portfolio, or do you just want to invest in a personal accessory that you might consider selling down the road?

“Serious investors are only interested in two things: buying low and selling high,” explains Khoo. “Most guys would lie to themselves about the watches they bought emotionally being investments – and most don’t ever sell!”

The second piece of advice is not to follow anecdotal evidence such as: “My friend told me he made money on one piece from the brand, so everything from that brand is investment grade.” While brands like Rolex and Patek Philippe are rich in cultural awareness and hold their value well, investing in a luxury timepiece should go further than street credit and making the seemingly obvious choice.

Investing in a timepiece that will outperform the stock market means catering to watch aficionados and mainstream brands are hardly the only luxury marques on their radar. The key is to be brand agnostic – and do your research.

“With 600 watch brands out there, every brand has got good stuff for the price we’re paying,” explains Khoo. “At the same time, there’s also things on the other end of the spectrum. You have to look at each brand, model, piece, condition, serial number, provenance, price, and so on and so forth.”

So what does make for a smart investment? Investing in luxury goods means selecting brands and models that are considered recession-proof, with the key term here being uncorrelated assets. While most investments are directly affected by the economy, smart investors should be on the lookout for things that the super-rich still buy – recession or no recession.

Like an ETF or a mutual fund, there’s really no foolproof way to predict which watches to buy today to create a nest egg for tomorrow.

Think about it like this: if you buy a US$20,000 watch from a shop that sells it for that price and everyone else buys it for that price, too, you can only make money by hoping to sell it for US$22,000. Why would someone give you a US$2,000 profit on your scratched, second-hand watch when they could go back to the shop and buy it brand new for US$20,000? Short answer: they wouldn’t.

“There is only a small percentage of watches truly considered as investment grade timepieces and the lucky group of collectors who can source and own one or two pieces from this segment understands very clearly what they need … [which is] a constant build-up of knowledge to spot and understand,” adds Ho.

The only types of watches Khoo recommends seriously investing in would be either a watch that money cannot buy, or a watch you can buy at a price that no one else can get, which typically means an initial investment of anywhere from US$250,000 to over US$5 million.

Serious watch investing as a private individual (where you keep all the watches yourself) is a relatively new form of investing, and while it is technically possible to outperform the stock market or make a profit on your daily driver, if you’re serious about turning a profit by investing in watches, it is likely to require a million dollar investment, a portfolio manager and potentially locking your prized timepieces in a safety deposit box for the long haul.

“If you really love watches, go buy what you like from the shops and wake up each morning looking at your watch and grinning stupidly,” Khoo says. “[However], if you want to make watches an investment, be careful to find [an investment manager] that makes money only when you do.”

Note: This story was originally published on SCMP and has been republished on this website.