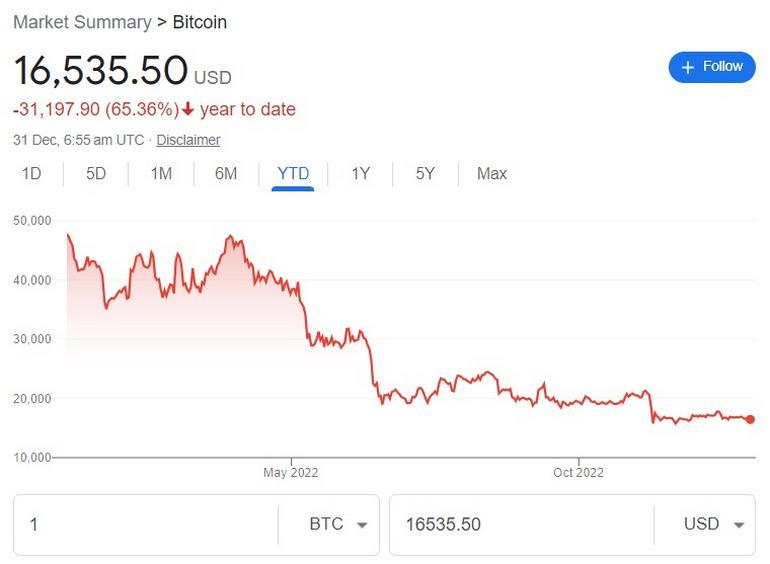

The dramatic crash in the cryptocurrency markets has been one of the biggest talking points of this year. After hitting an all-time high of $64,400 in November 2021, Bitcoin plummeted below $16,000 a year later, wiping out billions of dollars of investor money. The FTX trading platform’s collapse has forced investors to question the future of cryptocurrencies. However, I’m pretty sure you’ll be surprised to learn there’s something else that did even worse than Bitcoin as an investment asset. Believe it or not but Tesla Inc.’s stock price has proven to be more unfavorable than Bitcoin for investors in 2022.

While Tesla shares bounced back a little more than 8% in the last trading session, the EV manufacturer’s stock price has witnessed a drastic fall since the beginning of 2022. After hitting a lifetime high of $409.9 last year, the Tesla stock dropped to a 52-week low of $108 on Tuesday, which equates to a staggering year-to-date decline of 69%. In fact, it’s one of the worst-performing companies amongst the 500 tracked by Standard & Poor’s S&P 500 index.

While the company had managed to hit a market cap of over $1 trillion last year, this elevated Elon Musk to the top of the list of the world’s richest people, it sunk to $345 billion earlier this week. Investors have been left baffled by the company’s disastrous year, desperately trying to figure out the change in fortune. But why is Tesla stock declining?

Is it a victim of a larger tech decline?

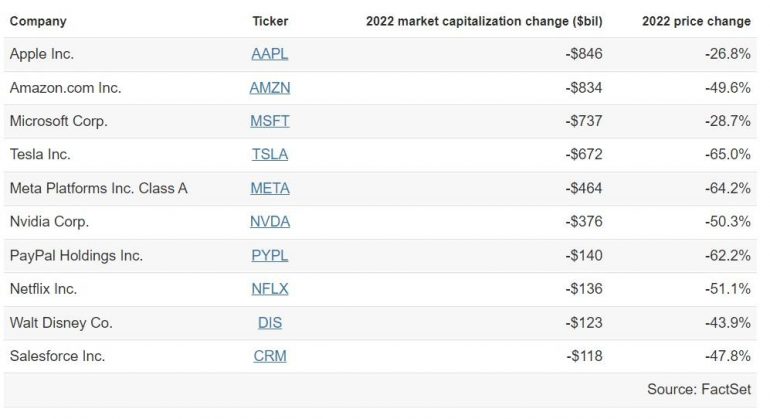

To say that the staggering decline in Tesla’s stock price is a one-off would be completely wrong. We know that Elon Musk is known to run Tesla more like a technology company rather than a traditional automobile manufacturing company, which is why it is treated in a similar fashion by investors as well. So it only makes sense to compare its performance with other major tech companies like Amazon, Microsoft, Alphabet, and Meta. You must be aware that it has been a brutal year for all these companies.

A total of $3.7 trillion in market capitalization was wiped out over the course of 2022 for these five companies. So, the answer is yes; Tesla is a victim of a larger tech decline. But Amazon, Microsoft, and Apple are in a much better state than Tesla and only Meta’s present situation is comparable to that of the celebrated EV maker.

Is it because of Musk’s long list of unfulfilled promises?

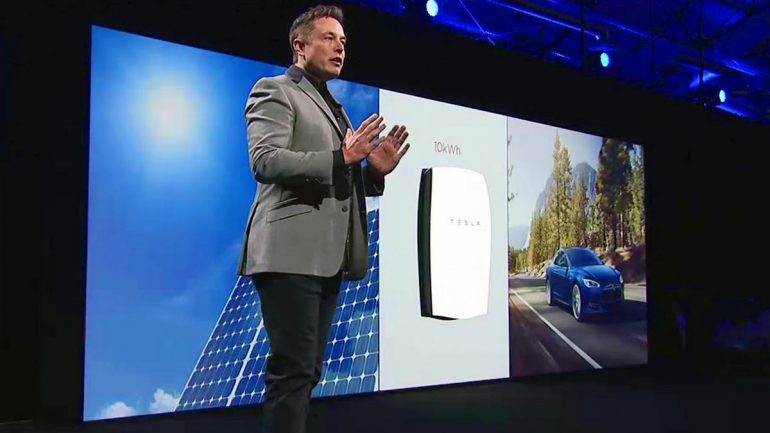

We have seen that in the past that Tesla’s stock price jumped every time Elon Musk revealed a new product or even give out a vague update on one of them. But the list of unfulfilled promises kept growing over the years and people have finally started to understand the reality. The Tesla Cybertruck and the long-awaited second-generation Roadster were showcased several years ago but they are nowhere to be seen, with very little real information on the actual production timelines.

Those who placed pre-orders are now starting to lose patience, especially in the case of people who reserved their Roadsters by paying thousands of dollars. However, the only positive came in the form of the Tesla Semi electric trucks. The company finally commenced the deliveries earlier this month, 5 long years after unveiling it. But the hype around Tesla is slowly starting to fade.

Should it be blamed on the whole Twitter fiasco?

Since the beginning of this year, Elon Musk has grabbed headlines for his Twitter antics rather than because of Tesla or SpaceX. Interestingly, many people have almost stopped talking about The Boring Company and the highly-publicized Solar Roof project. Tesla is going through a very challenging time, having to deal with supply chain issues, losing momentum in China, crackdowns on its Autopilot driver assistance software, and growing competition.

Dear Twitter Advertisers pic.twitter.com/GMwHmInPAS

— Elon Musk (@elonmusk) October 27, 2022

However, the billionaire visibly dedicated more time to the hostile takeover of Twitter since the beginning of this year, which has started to trouble investors. While his Twitter has been a complete shit show till now, there have been growing voices for Musk to step down as the CEO of Tesla, and it’s only going to get worse unless he can turn it around quickly.

Over the course of 2022, Elon Musk sold Tesla stocks worth $40 billion, mostly to fund the Twitter acquisition. Naturally, it has had an adverse impact on the stock price as well as investor confidence. People have started to see Musk as an impulsive person who gets distracted easily and might not have the capacity to steer Tesla in the right direction anymore. The decline in Tesla stock has cost Elon Musk dearly as he has become the first person to lose $200 billion in a year. However, Musk has proven people wrong in the past, and he might be able to pull off another miracle. It will be interesting to see if Tesla is able to get back onto the growth trajectory in 2023.