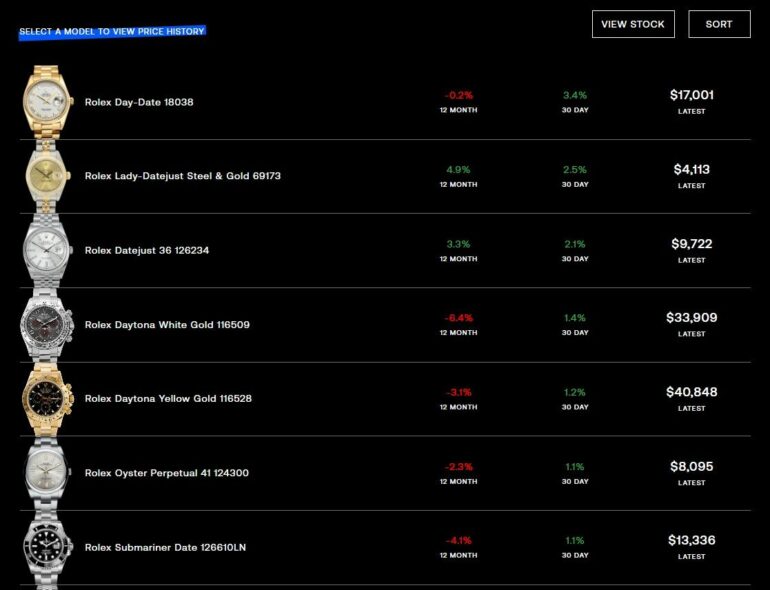

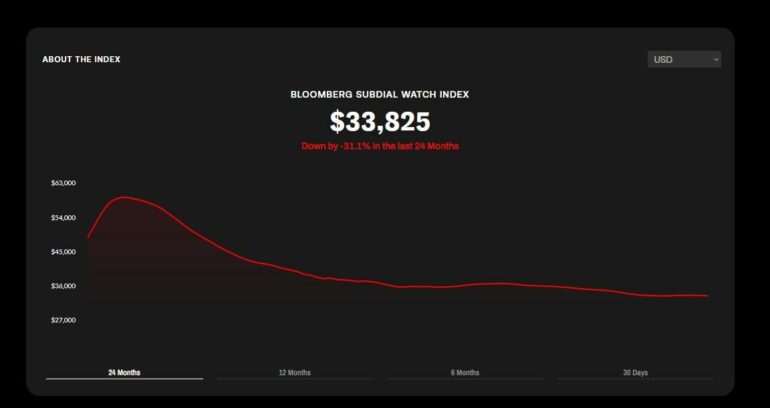

The prices of pre-owned Rolex watches might be stabilizing after witnessing continuous declines for more than a year-and-a-half, according to the Bloomberg Subdial Watch Index. The Subdial Index, which tracks the 50 most traded Swiss watches by transaction value, has been more or less flat over the last 30 days. However, Subdial’s index for Rolex models is up by 0.7% over the same period. It could be an early sign that the prices for pre-owned luxury timepieces, especially Rolexes, might have finally bottomed out after the Subdial Watch Index hit fresh two-year lows in November last year.

The prices for second-hand high-end Swiss watches saw a meteoric rise right after the pandemic sent the whole world into complete disarray in 2002. The COVID-19 lockdowns resulted in severe supply-chain disruptions and production stoppages, which created a huge shortage of new watches in the market.

Some people saw an investment opportunity in this and hyped up the prices of models from Rolex, Patek Philippe, and Audemars Piguet. However, the cryptocurrency crash in April 2022 and rising interest rates sent the market for pre-owned luxury watches into a tailspin.

The Subdial Index has plummeted by more than 30% over the last two years. It witnessed sharp declines till November last year when the prices of some Rolex models crashed by as much as 7% over a single month. However, signs of recovery started showing up last month, with models like the highly desirable Rolex Pepsi holding their value. Although it’s too early to predict if the market for pre-owned Swiss watches might see a resurgence this year, the expectation that the US interest rates will begin declining this year is bringing in positive sentiment into the market. Interestingly, the crypto market also hit a 2-year high recently, which could also be one of the big reasons for the prices of pre-owned luxury watches to stabilize. Will the hysteria we witnessed in 2020 return this year? Well, only time will tell.