Unless you have absolutely no interest in automobiles, I don’t need to remind you that the Ferrari LaFerrari is one of the most important and celebrated cars of the 21st century. It was introduced at the 2013 Geneva Auto Show as Ferrari’s next halo car along with being its first-ever production hybrid supercar. Only a total of 710 examples of the LaFerrari were made, including 500 units of the coupe and 210 examples of the Aperta, making it a very rare modern supercar. Given its significance and rarity, LaFerrari’s immense desirability among collectors is hardly any surprise. While the coupe version had a base price of $1.4 million when it was launched almost a decade ago, you would be really lucky to find a pre-owned LaFerrari below $4 million. However, we’ve seen examples of the LaFerrari coupe selling for as much as $7 million in the past.

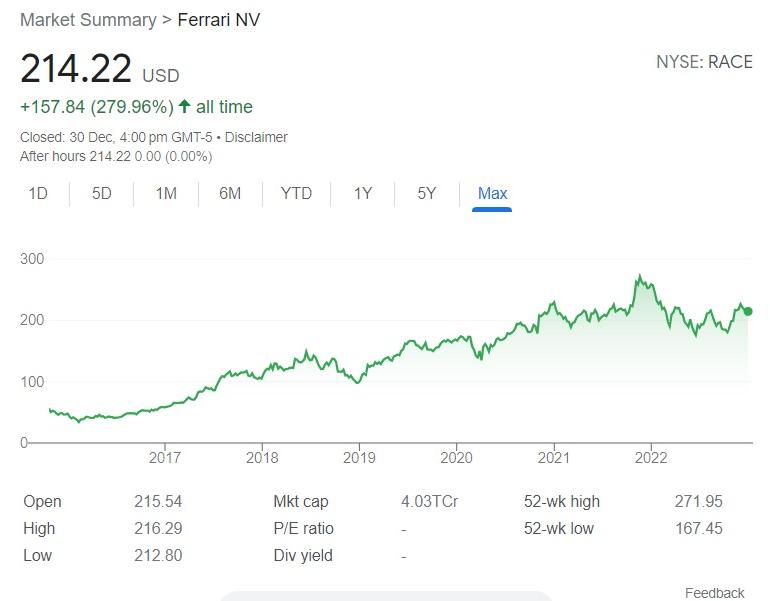

Like it or dislike it but many buyers purchase such amazing automotive creations to flip them for profit. Despite the fact that Ferrari is known for going after such customers with lawsuits and getting them blacklisted forever, many collectors still see these rare beauties as investments. An almost guaranteed 3X return in less than a decade is too tempting for these people. But here’s something very interesting – had someone invested in the Ferrari stock when it was listed on the stock exchange back in 2015, they would have made a lot more money. How much, you ask? Well, those who bought Ferrari shares when it was listed in the US on October 20, 2015, and still have them in their portfolio have quadrupled their investment. However, had anyone invested in the Ferrari stock when it had plummeted to its lifetime low of close to $30 back in 2016 and sold it when it hit a lifetime high of $271 last year would have made a staggering return of 9X.

Imagine investing $1.5 million in Ferrari shares in 2016 rather than buying a LaFerrari. You would have made a crazy profit of $12 million by selling it in November last year. It would have been enough to buy three LaFerrari; or even better, buy the hybrid hypercar trifecta by getting yourself a LaFerrari, a McLaren P1, and a Porsche 918.

If you think the 9X return in 5 years by an automotive company is crazy, wait till you hear about the meteoric growth of Tesla’s stock over the same period. Instead of investing $1.5 million in Ferrari’s shares in 2016 had you put that money into Tesla shares, you would have made a profit of almost $45 million by selling the Tesla stock when it peaked in November last year. However, 2022 proved to be disastrous for Tesla with its stock price plummeting by more than 65%. Ferrari’s shares also witnessed deep cuts in 2022 but it wasn’t as bad as that of Tesla. Ferrari’s blockbuster listing in 2015 proved to be a blueprint for its competitors. While Porsche carried out the largest IPO in Europe’s history in terms of market cap a few months back, Lamborghini is also expected to make its debut on the stock exchange soon.