As luxury watchmaking giant Rolex rolls out its 2025 pricing strategy, a fascinatig dichotomy has emerged that tells us as much about the global economy as it does about the Swiss watchmaker’s business strategy. While steel watch enthusiasts can breathe a collective sigh of relief, collectors eyeing precious metal timepieces are facing significant price adjustments that reflect broader economic realities.

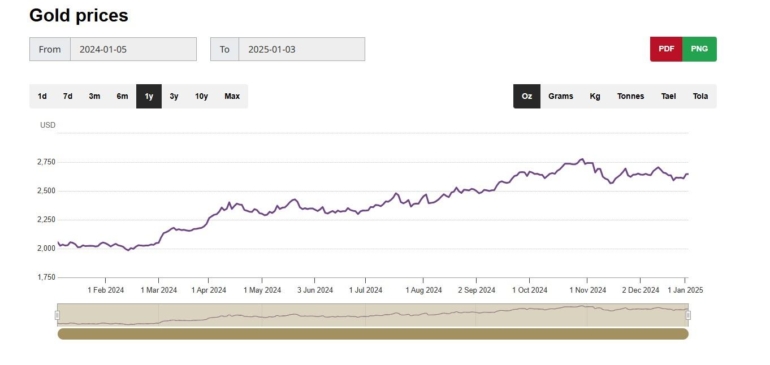

The crown jewel of Swiss watchmaking has implemented a notably bifurcated pricing approach for 2025: stainless steel models see minimal increases of around 1-1.5%, while gold watches face substantial hikes of approximately 11% across most collections. This strategic pricing move appears directly tied to the remarkable surge in gold prices throughout 2024, which saw the precious metal climb from $2,000 to $2,800 per ounce – a staggering 40% increase.

Perhaps most telling is the treatment of the brand’s flagship Cosmograph Daytona collection. While the steel versions received a modest €400 (~$411) increase, their golden counterparts experienced the most dramatic adjustments in the entire lineup, with prices soaring by 18.5% – translating to increases between €6,000 (~$6170) and €8,000 (~$8225) per timepiece.

The precious metal impact extends beyond pure gold models. Two-tone watches, known in Rolex parlance as “Rolesor,” haven’t escaped the economic pressures, seeing price increases averaging 8%. This middle-ground approach for bi-metal watches suggests a careful calculation of material costs and market positioning.

Interestingly, platinum models have remained relatively stable with increases of only around 1%, reflecting the metal’s more modest market fluctuations throughout 2024. Similarly, titanium pieces like the Deepsea Challenge saw moderate adjustments, positioning themselves between steel and gold in terms of price volatility.

Industry experts see these price adjustments as more than simple cost passing. Speaking to Robb Report, Paul Altieri of Bob’s Watches noted: “The Rolex price increases aren’t just an economic reaction. It’s a recalibration of value in a world where craftsmanship and scarcity remain timeless currencies.” This perspective suggests that while material costs play a significant role, Rolex continues to factor in the complex dynamics of luxury market positioning and perceived value.

As we move deeper into 2025, these price adjustments offer a window into both Rolex’s strategic thinking and the broader luxury market’s response to economic pressures. The question remains: will this two-track pricing strategy become the new normal for luxury watchmaking, or is it a temporary response to extraordinary market conditions? Only time will tell, but one thing is certain – the watch industry’s response to these changes will be fascinating to observe.