China had a sweet spot secured for its self when it came to luxury. We, however, find ourselves wondering about its future safety. According to latest reports, the country is experiencing what could best be termed a “luxury slowdown”. This is a direct result of government intervening in “exuberant” spending right down till its crackdown.

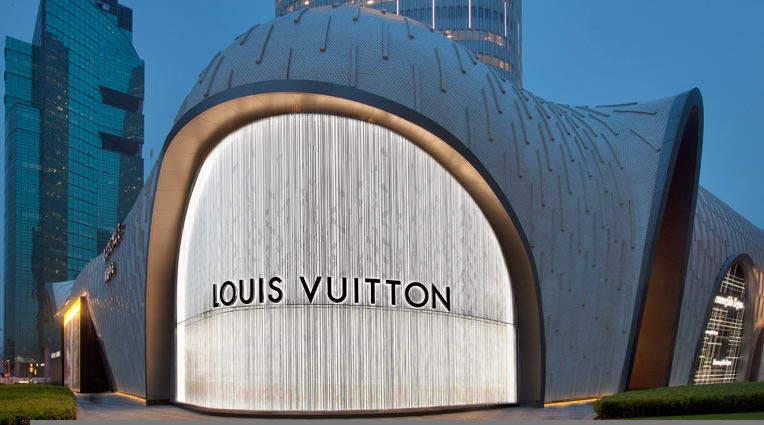

Greater China currently accounts for a quarter of Louis Vuitton’s revenue, 35 per cent of Cartier’s and 45 per cent of Omega’s, while Hermès recently estimated that more than half of its global sales would soon come from the country. Erm, check again, Hermès. Stats are about to change!

Analysts now predict growth would slow dramatically in China. “Just a few years ago, a slowdown in Chinese consumption would barely have produced a ripple in the luxury sector,” said Luca Solca, a sector analyst. “Today, it has the potential to produce a tidal wave.”

A tidal wave has already been produced as far as Hugo Boss and Rémy Cointreau are concerned. The German fashion house and French drinks group are finding themselves at a loss, period. As a result, both companies are blaming profit warnings on the nation.

Boss admitted it would miss its $1 billion operating profit target for 2015 as chief executive Claus-Dietrich Lahrs said China “came down to a rather disappointing growth rate for the luxury industry in 2013.” Meanwhile liqueurs, spirits, champagne and cognac owner Rémy Cointreau said it expected a “substantial” drop in annual profit caused by weaker sales in Europe and Asia, as first-half operating profits fell 7.3 per cent to $180 million.

Not all looks bleak in the situation, however. A clear set of winners seems to be sailing through 2013 with solid sales. And by “clear set”, I mean Bottega Veneta, Stella McCartney, Alexander McQueen and Balenciaga. The more affordable “masstige” category is also seeing success, as Coach experienced a 35 percent jump in sales for the third quarter.

So even if China’s slowdown is long-term, brands with the right marketing strategies and an understanding of Chinese luxury consumers can stand good chance. Otherwise there is always the good old Chinese globetrotter. Add, “deep-pocketed” to that and voila! Slowdown shmodown.

[Via – Vogue and Independent and Jingdaily]